Vantage Plus Research Team

May 7, 2024

Fundamental data

The positive trend in stock markets appears to be continuing, which also seems to be extending to crypto markets. Some tokens have seen a brilliant upswing last week, and further potential could now be signaled. The weak dollar in particular is also helping the market here.

The previous correction of the last few weeks could now be halted for the time being, although only slight upward potential can be seen at times. However, news from BlackRock, which announced that pension funds are also turning their attention to crypto ETFs and could therefore act on the buy side, should make investors sit up and take notice.

Technical analysis:

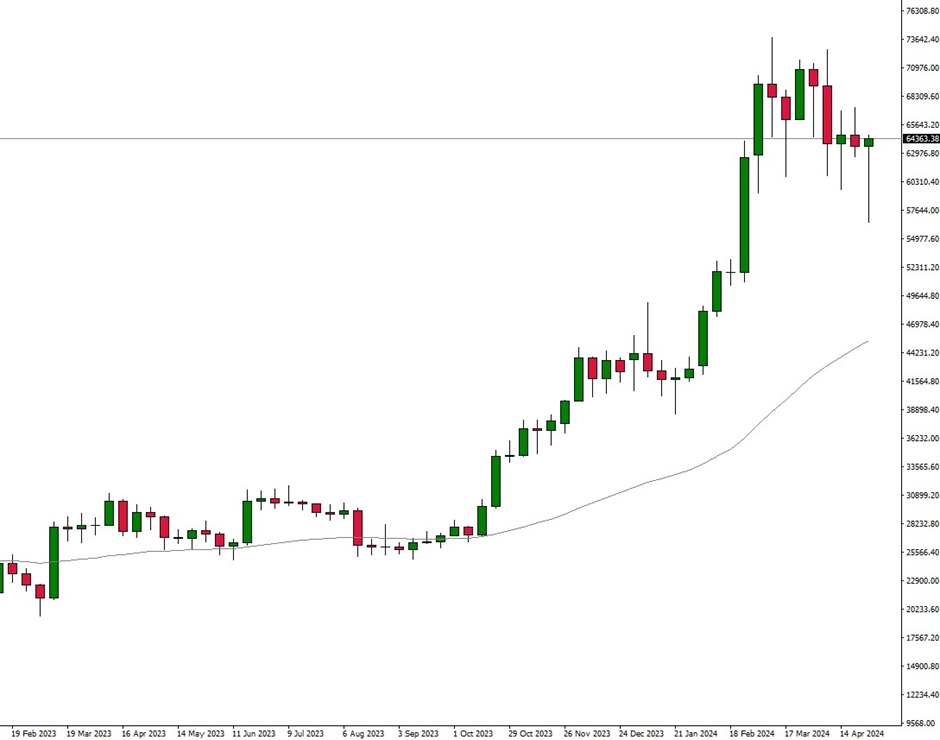

– BTC: Bitcoin is trading at USD 64,400. The market had followed the recent trend lower last week, but was able to recover by the end. The result with the pinbar candle now indicates possible upside potential, as the trading candle on the weekly chart suggests.

The weak Dollar and the positive risk sentiment in stock markets are also having a positive effect here. If geopolitical tensions remain calm, the trend could hence continue upwards. According to the daily chart, BTC is also trading above the 50- moving average again, which could continue to be seen as positive.

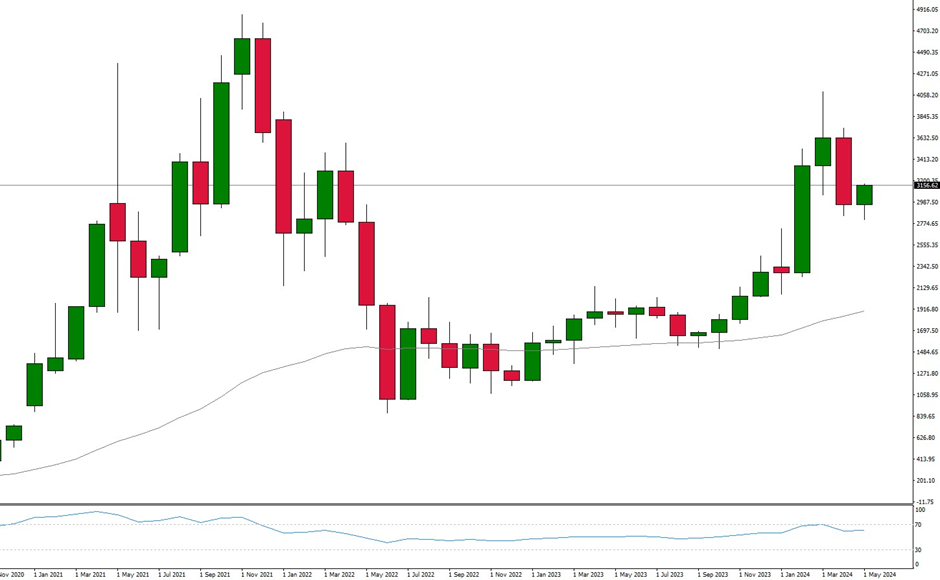

– ETH: Ethereum is trading at USD 3,157. The trend according to the long-term monthly chart continues to show possible negative potential, with a slight upward trend during the first trading days in May.

However, this could turn negative and cause the market to move lower again. Below the last trading candle from April at around USD 2,900, there could be further weak potential if the recent upward trend does not continue.

– XRP: Ripple is trading at USD 0.5345 and remains above the 50- moving average based on the monthly chart. Although last trading candles continue to show sideways momentum at best, falling prices have been bought back up again and again, so that there is still good downside protection.

The weekly chart shows that the rising trend line was tested last week, but not sustainably broken to the downside. This could further underpin positive potential.

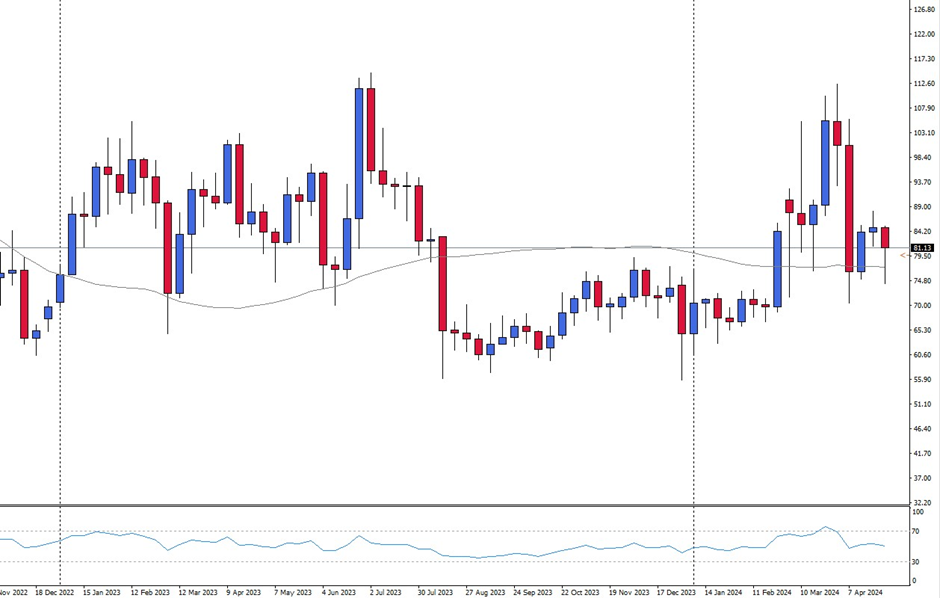

– LTC: Litecoin is trading at USD 81.60 and came under renewed pressure last week. However, the 50-period moving average was once again able to protect the market from further pressure, allowing positive momentum to prevail in the end. Fresh upside potential could now emerge at USD 86.30.

Overall, however, Litecoin is not showing any momentum and is therefore likely to remain stuck in a sideways pattern. Strong upward potential could therefore only emerge again above USD 109.00.

Vantage does not represent or warrant that the material provided here is accurate, current, or complete, and therefore should not be relied upon as such. The information provided here, whether from a third party or not, is not to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any financial instruments; or to participate in any specific trading strategy. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. We advise any readers of this content to seek their own advice. Without the approval of Vantage, reproduction or redistribution of this information is not permitted.

Vantage does not represent or warrant that the material provided here is accurate, current, or complete, and therefore should not be relied upon as such. The information provided here, whether from a third party or not, is not to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any financial instruments; or to participate in any specific trading strategy. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. We advise any readers of this content to seek their own advice. Without the approval of Vantage, reproduction or redistribution of this information is not permitted.

About Us

Premium Client

Premium Trading

Complimentary Resources