Vantage Plus Research Team

May 7, 2024

Trends in markets

The weak dollar continues to help the positive risk appetite, while at the same time equity markets are moving upwards again. Is this just a correction in the Greenback’s upward trend, or has the negative data from the eurozone already been priced into the markets, with hardly any negative potential emerging at present? In any case, the dollar index is currently at the support zone at 105.00 and could therefore move upwards again if this is not broken to the downside. However, it remains to be seen whether the old saying ‘sell in may and go away’ will prove true again.

Important events this week:

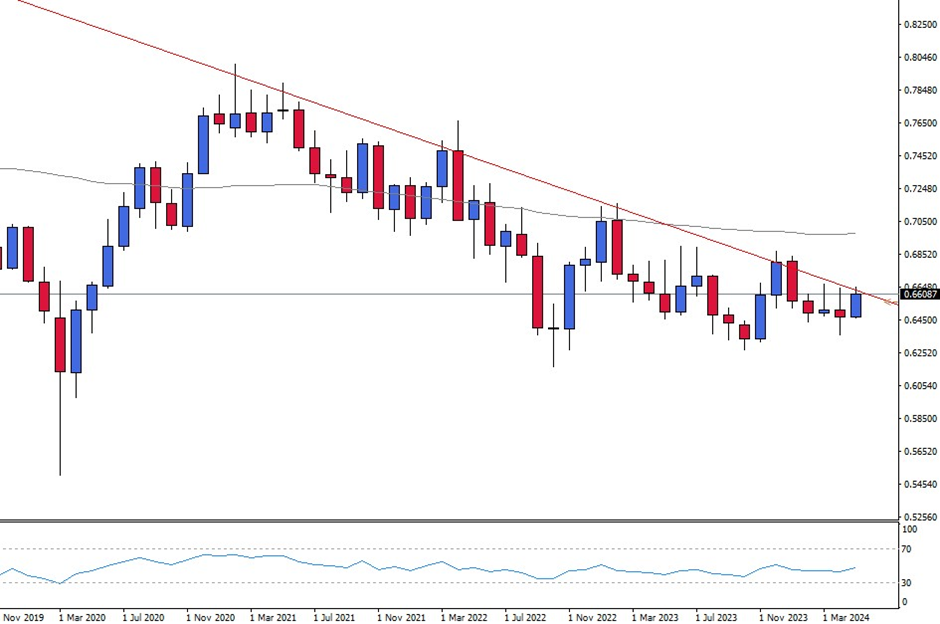

– AU meeting minutes- two weeks after the interest rate decision, the meeting minutes are published again. As the Australian dollar is still in strong demand against other currencies, there could be further positive potential if the general view that the central bank intends to stick to the current interest rate continues to strengthen. From a chart perspective, the Aussi has already been able to move positively in the past week and could continue to rise.

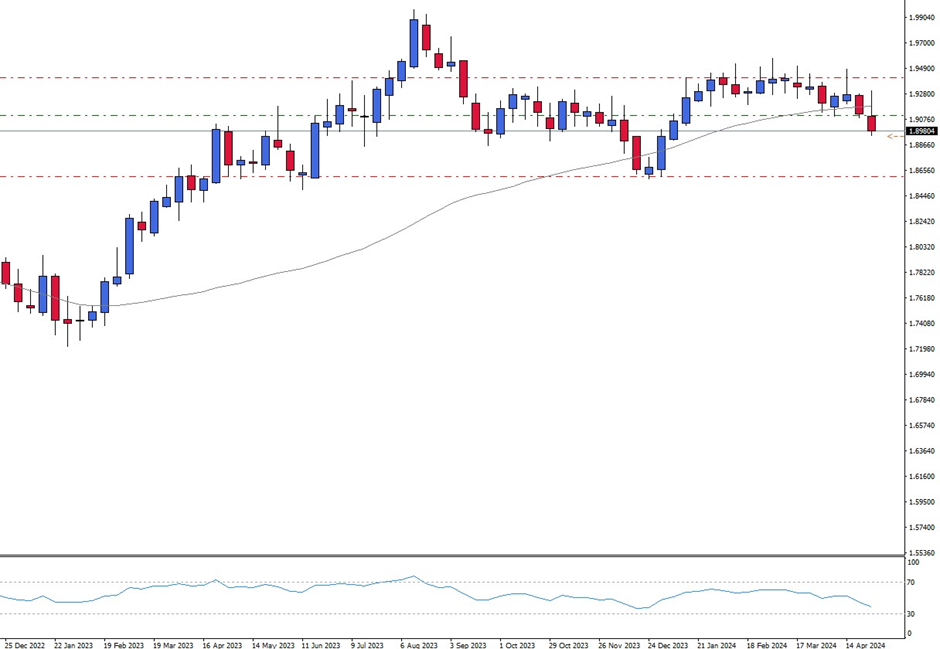

A look at the monthly chart reveals positive momentum here, although the price was unable to move any further upwards at the 0.6600 mark. It is therefore important to keep an eye on this striking zone this week, whereby a breakout to the upside could then have a further positive effect. The GBPAUD currency pair is also exciting, as the negative trend from the previous week continued.

The AUD could therefore continue to move the market downwards, provided that the weekly chart shows that downward pressure could increase further, especially below the 50- moving average. The minutes will be published on 07 May at 06:30 CET.

– UK monetary policy report- The monetary policy report from the UK central bank could also cause new volatility in markets. Last but not least, there is potential momentum in the GBPAUD currency pair, as discussed above. The Pound could come under further pressure, as other charts also show.

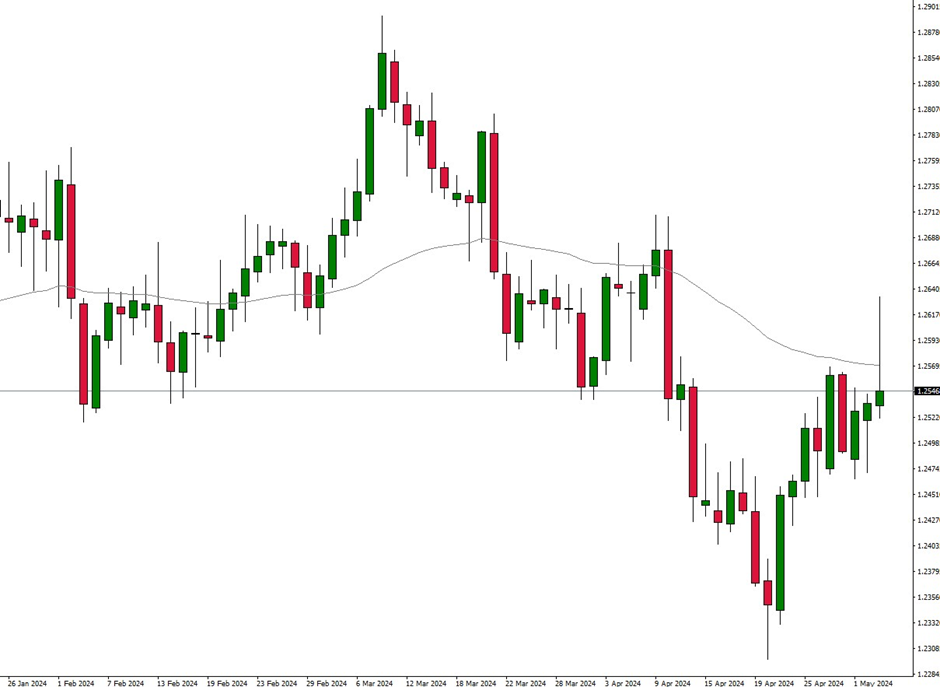

The GBPUSD currency pair also continues to show weak potential on the daily chart. Last week’s Friday pinch through the 50- resistance level could now release further downward pressure. There is also a horizontal resistance zone at 1.2565, which could indicate further downside momentum. There could be further downward pressure if there are new details on further interest rate adjustments. The report will be published on 09 May at 13:00 CET.

Vantage does not represent or warrant that the material provided here is accurate, current, or complete, and therefore should not be relied upon as such. The information provided here, whether from a third party or not, is not to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any financial instruments; or to participate in any specific trading strategy. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. We advise any readers of this content to seek their own advice. Without the approval of Vantage, reproduction or redistribution of this information is not permitted.

Vantage does not represent or warrant that the material provided here is accurate, current, or complete, and therefore should not be relied upon as such. The information provided here, whether from a third party or not, is not to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any financial instruments; or to participate in any specific trading strategy. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. We advise any readers of this content to seek their own advice. Without the approval of Vantage, reproduction or redistribution of this information is not permitted.

About Us

Premium Client

Premium Trading

Complimentary Resources