Vantage Plus Research Team

May 14, 2024

Crypto markets are currently hardly being supported by the weak dollar. This could actually lead to rising prices. On the contrary, they are rather weak with no significant upward potential. It seems as if the markets want to wait for further news before providing new impetus.

Technical analysis:

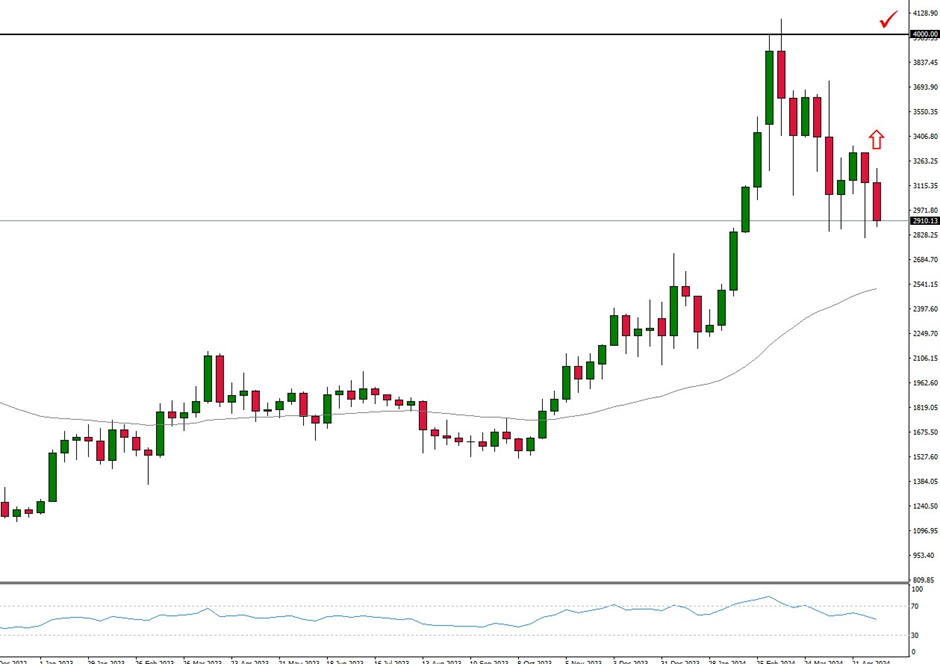

– BTC: Bitcoin is trading at USD 63,022 and has barely moved last week. The market thus remains at the important support zone, which was defended. On the other hand, there is currently a lack of positive impetus to make new price rises appear likely. In this respect, only a break above the all-time high of USD 70,000 may provide strong impetus. Until then, however, entry points could be profitable on a short-term basis. Alternatively, it may be worth taking a look at the monthly chart.

In the past, new highs were followed by major corrections that usually lasted several months as the previous arrows on the above chart show.

– ETH: Ethereum is trading at USD 3,029.50 and, like Bitcoin, continues to trade in a sideways pattern. However, the chart shows broad support on a weekly basis, which is determined by the psychological level at USD 3,000.00. Falling prices are therefore only likely to occur again below this zone. In addition, the positive trend could stabilize again, as ETH likes to move positively when the price of Bitcoin weakens.

The weekly chart shows possible potential in the USD 3,150.00 range. An entry there could be worthwhile and then move the market towards USD 4,000.00. A weak dollar would also support this trend.

– XRP: Ripple is trading at USD 0.5160 and continues to show weak potential in the market. The weekly chart points to falling prices here, as Ripple continues to trade below the 50-moving average, which currently sits at USD 0.5050.

Last week, this area was briefly breached on the upside, but could not be maintained. The resulting trading candle now indicates further pressure in the market. This could then intensify further at USD 0.4900 if the psychological round level of USD 0.5000 is also broken to the downside.

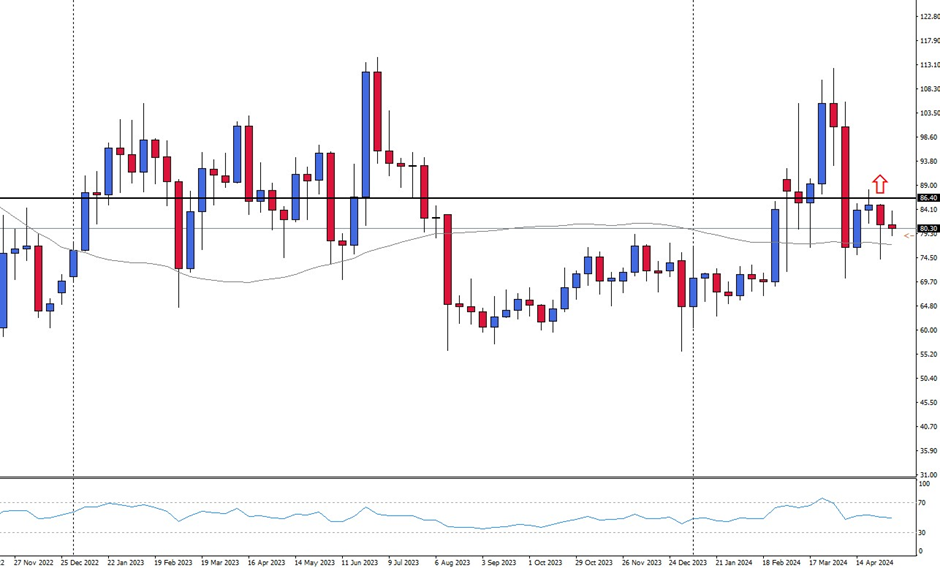

– LTC: Litecoin is trading at USD 83.50 and continued to move above the important 50- moving average last week. Provided this zone is not breached to the downside, the price could continue to rise.

The technical pin bar a fortnight ago continues to support the price, whereby an upward entry above the price range at USD 86.40 could arise. Further upside potential could then quickly emerge towards USD 110.00, where the upcoming technical resistance area could then limit the market.

Vantage does not represent or warrant that the material provided here is accurate, current, or complete, and therefore should not be relied upon as such. The information provided here, whether from a third party or not, is not to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any financial instruments; or to participate in any specific trading strategy. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. We advise any readers of this content to seek their own advice. Without the approval of Vantage, reproduction or redistribution of this information is not permitted.

Vantage does not represent or warrant that the material provided here is accurate, current, or complete, and therefore should not be relied upon as such. The information provided here, whether from a third party or not, is not to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any financial instruments; or to participate in any specific trading strategy. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. We advise any readers of this content to seek their own advice. Without the approval of Vantage, reproduction or redistribution of this information is not permitted.

About Us

Premium Client

Premium Trading

Complimentary Resources