Vantage Plus Research Team

May 21, 2024

Fundamental data

Capital inflows into Bitcoin ETFs could be one reason why markets are able to continue their overall recovery. These might continue this week, which could lead to further momentum. Previously, however, this trend had developed negatively, which had led to selling pressure. Some market participants had even spoken of a failure of the ETFs. Other market observers now expect inflows of several billion capital per day.

Another milestone this week could also be a decision from the US. If the House would make a decision, the CFTC could act as regulator and might be given oversight of the crypto markets in general. This could then improve consumer protection, as the security issue surrounding the custody of customer assets in the event of bankruptcy could be regulated.

Technical analysis:

– BTC: Bitcoin is trading at USD 66,870 and has been able to move higher. The breakout above the red-colored resistance zone can be found on the daily chart.

The positive trend might hence continue, provided that further momentum will follow this week. In long-term charts, the previous correction of the last few trading weeks could now have come to an end. An upward breakout to the USD 70,000 range could then lead to further gains.

– ETH: Ethereum is trading at USD 3,110.00. ETH was also able to behave positive last week, although further strong impetus failed to materialize. Based on the daily chart, the market is currently trading below the 50-moving average, which is likely to be seen as strong resistance.

However, a break to the upside could release further potential and then cause Ethereum to move towards the USD 4000.00 level. It then remains to be seen whether a breakout to the upside might follow.

– XRP: Ripple is trading at USD 0.5260 and thus remains in a sideways trend. Only if the market can break above the 50-moving average and trade above the USD 0.5500 zone upside momentum could follow.

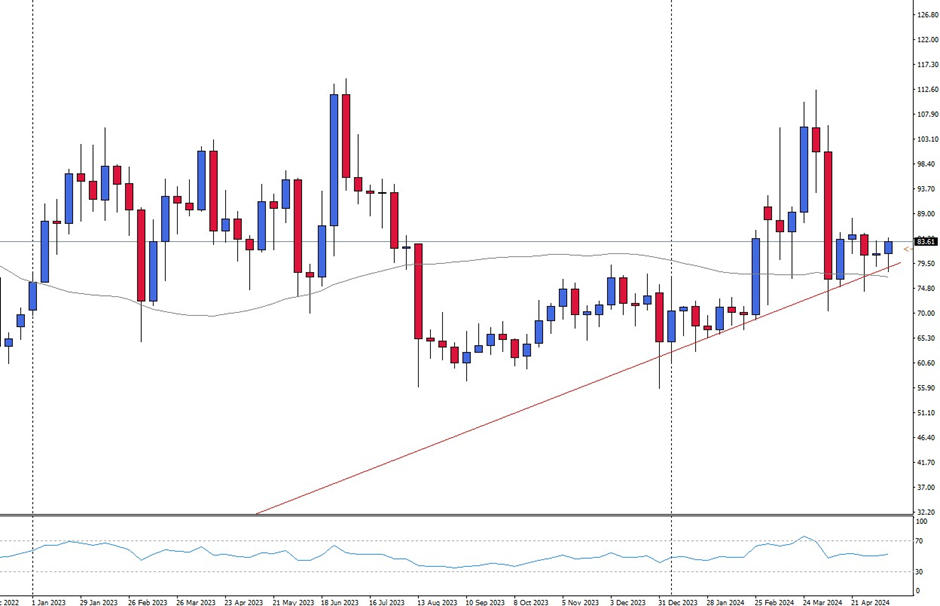

The bearish trading candle from early April is likely to continue to cause negative sentiment. On the other hand, the price of XRP has not yet fallen below the rising trendline in red color, which should be seen as a positive sign.

– LTC: Litecoin is trading at USD 84.30 and continues to show little upward momentum. However, as the market remains above the 50-moving average, there could be further potential medium term.

The rising trend line could also indicate further upward potential, provided it is not broken to the downside. Litecoin could then rise again to the USD 100.00 mark.

Vantage does not represent or warrant that the material provided here is accurate, current, or complete, and therefore should not be relied upon as such. The information provided here, whether from a third party or not, is not to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any financial instruments; or to participate in any specific trading strategy. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. We advise any readers of this content to seek their own advice. Without the approval of Vantage, reproduction or redistribution of this information is not permitted.

Vantage does not represent or warrant that the material provided here is accurate, current, or complete, and therefore should not be relied upon as such. The information provided here, whether from a third party or not, is not to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any financial instruments; or to participate in any specific trading strategy. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. We advise any readers of this content to seek their own advice. Without the approval of Vantage, reproduction or redistribution of this information is not permitted.

About Us

Premium Client

Premium Trading

Complimentary Resources