Vantage Plus Research Team

May 30, 2024

Important events this week:

Last week, equity markets experienced short-term setbacks, although these were sometimes short-lived. If new all-time highs are broken upwards again and the positive risk sentiment continues, this could also have a positive impact on risk-positive currencies such as the AUD, NZD as well as the EUR and GBP. Yields on US bonds continue to point upwards and the US Federal Reserve could remain neutral and not adjust interest rates any time soon. However, this does not appear to be an obstacle to the positive risk mentality.

AU – Consumer Price Index – As in the previous month, the consumer price index is expected to remain stable at 3.4%. The data continues to be an important indicator for the central bank and thus play a decisive role in determining the course of interest rates. During the last publication, a slight increase to 3.5% was seen, which was able to move the Aussi slightly upwards. If this trend is confirmed this month, the Australian dollar could make further gains. Last week, however, the AUD lost potential, especially against the USD.

As the monthly chart above suggests, the falling trend could thus continue and push further strength into the US Dollar. Fresh downside potential could then emerge in the 0.6450 area. The data will be published on Wednesday, 29 May at 03:30 CET.

DE – CPI – The German CPI is only a small part of the Eurozone as a whole, but due to the importance of the German economy in international comparison, deviations also cause potential volatility in the EUR. Expectations in recent months have mostly been undercut so far, which could mean further weakness for the EUR in this case as well.

However, a look at the weekly chart of the EURUSD currency pair shows that the EUR continues to show strength. In particular, the break of the 50- moving average could provide further potential. If the expectation of 0.2% does not materialize, a higher inflation rate could move the common currency further upwards. The data will be published on Wednesday 29 May.

US – Gross Domestic Product- Gross Domestic Product is generally a backward-looking indicator, but with little important data this week, let’s take a look at it anyway. The figure from the last quarter suggests economic growth of just 1.3%, although this has weakened further in recent months.

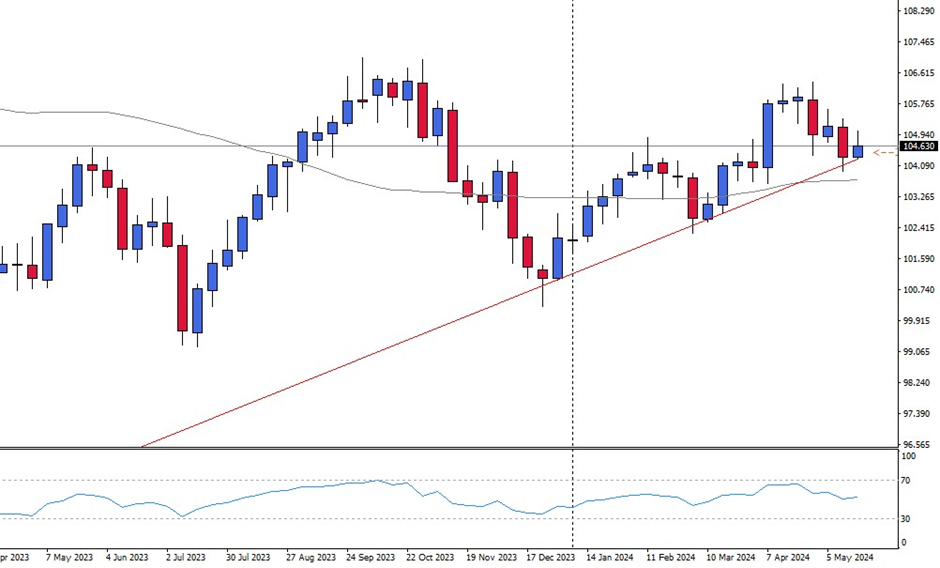

A look at the USD index (USDXr) shows possible potential in both directions. If the red uptrend line is not broken to the downside, the dollar could continue to move higher. The data will be published on Thursday, 30 May at 14:30 CET.

Vantage does not represent or warrant that the material provided here is accurate, current, or complete, and therefore should not be relied upon as such. The information provided here, whether from a third party or not, is not to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any financial instruments; or to participate in any specific trading strategy. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. We advise any readers of this content to seek their own advice. Without the approval of Vantage, reproduction or redistribution of this information is not permitted.

Vantage does not represent or warrant that the material provided here is accurate, current, or complete, and therefore should not be relied upon as such. The information provided here, whether from a third party or not, is not to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any financial instruments; or to participate in any specific trading strategy. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. We advise any readers of this content to seek their own advice. Without the approval of Vantage, reproduction or redistribution of this information is not permitted.

About Us

Premium Client

Premium Trading

Complimentary Resources